News Feed

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

News Feed

ChaiViz

06.11.2025

The esports world watched Ninjas in Pyjamas dominate Counter-Strike competitions for years. Now, the legendary Swedish organization's parent company is mining Bitcoin at a scale that dwarfs most esports revenue streams. NIP Group just closed a $249 million deal that transforms them into one of the world's largest publicly traded cryptocurrency miners, generating approximately 160 Bitcoins monthly - worth close to $20 million at current market prices.

As we can all see, this is no side hustle. The Abu Dhabi-based company now operates mining infrastructure producing 11.3 exahashes per second of computing power, a figure that places them among the elite tier of global Bitcoin operations. For context, that's enough processing capability to solve complex cryptographic puzzles faster than most small countries could manage.

Co-CEO Hicham Chahine frames the pivot as strategic positioning rather than abandonment of esports roots. "Building large-scale computing power gives us a stronger foundation to pursue opportunities in high-performance computing, crypto mining, and AI applications in gaming and entertainment," Chahine explained in the announcement.

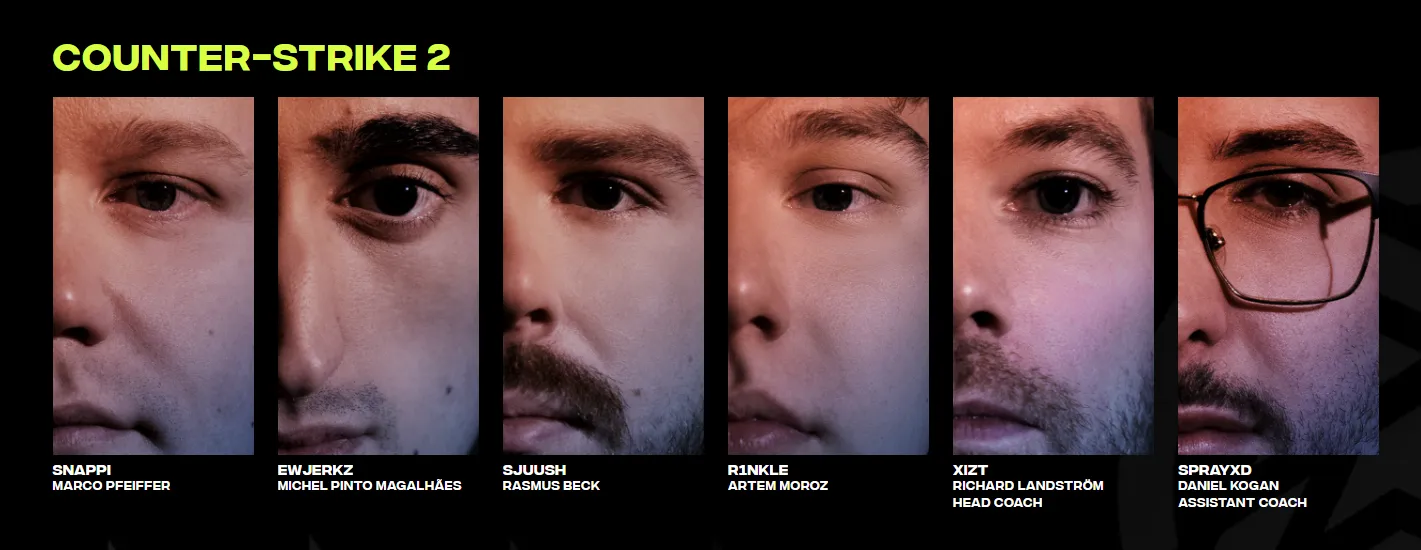

Photo credit: Ninjas in Pyjamas/Fartein Rudjord

The diversification strategy extends beyond cryptocurrency. NIP Group has invested heavily in AI development, live entertainment ventures, and esports hotels across China. Each initiative receives backing from the Abu Dhabi Investment Office, suggesting deep institutional confidence in the company's transformation.

What started as a professional Counter-Strike organization has evolved into a technology conglomerate that happens to maintain an esports division. The monthly Bitcoin revenue alone exceeds what most top-tier esports teams generate annually through tournament winnings, sponsorships, and merchandise combined.

The original Ninjas in Pyjamas brand still fields competitive rosters, but the financial reality has shifted dramatically. While professional players grind through qualifiers and practice sessions, the parent company's mining operations generate passive income that makes prize pools look modest by comparison.

Industry observers question whether this extreme diversification benefits or undermines the esports operations. Traditional sports organizations occasionally explore alternative revenue streams, but few pivot this aggressively into unrelated sectors. The Counter-Strike community remembers NIP as trophy-hoisting competitors, not cryptocurrency miners.

Yet the business logic appears sound from NIP Group's perspective. Esports remains notoriously difficult to monetize at scale, with most organizations struggling to achieve profitability despite massive viewership numbers. Cryptocurrency mining, while volatile, offers more predictable revenue streams and requires less direct competition with rival organizations.

The computing infrastructure also positions NIP Group for emerging opportunities in AI-powered gaming applications and high-performance computing services. These sectors promise growth potential that traditional esports broadcasting and merchandise sales struggle to match.

The geographical and strategic evolution mirrors broader trends in esports ownership. Gulf region investors have increasingly acquired stakes in gaming organizations, bringing substantial capital but sometimes shifting organizational priorities away from pure competitive performance.

Photo by André François McKenzie on Unsplash

NIP Group's transformation raises questions about identity and mission. Does a company that generates 95% of revenue from Bitcoin mining still qualify as an esports organization? Should fans celebrate the financial success even if it comes from sources completely unrelated to competitive gaming?

The answers depend on whether NIP Group maintains meaningful investment in their competitive rosters despite the cryptocurrency windfall. Some esports fans worry that mining profits could incentivize parent companies to reduce support for expensive, low-margin competitive operations. Others hope the financial cushion allows for better player salaries and infrastructure without constant pressure for immediate returns.

Traditional sports offers parallels. Red Bull owns multiple racing teams and extreme sports athletes primarily as marketing vehicles for their beverage business. Nobody questions whether Red Bull Racing is a legitimate Formula 1 team despite energy drink sales funding the operation. Perhaps NIP Group's mining operations simply represent a more capital-intensive version of that model.

The $20 million monthly mining revenue creates intriguing possibilities if reinvested into esports. That amount could fund multiple championship-caliber rosters across several games, build state-of-the-art training facilities, or establish academy systems that develop emerging talent. Whether NIP Group pursues these opportunities or treats esports as a legacy brand while focusing on crypto remains uncertain.

The competitive Counter-Strike scene continues regardless of parent company diversification strategies. Players still clutch impossible rounds, teams still upset favorites, and tournaments still crown champions. Whether those champions represent organizations primarily focused on esports or cryptocurrency mining might matter less than maintaining competitive integrity and player welfare.

NIP Group's evolution from Counter-Strike powerhouse to Bitcoin mining operation represents the most dramatic revenue diversification attempt in esports history. Success will ultimately be measured not just in mining profits, but in whether the original Ninjas in Pyjamas brand maintains relevance in competitive gaming while its parent company pursues vastly different business objectives.

ChaiViz

06.11.2025

Article TAGS